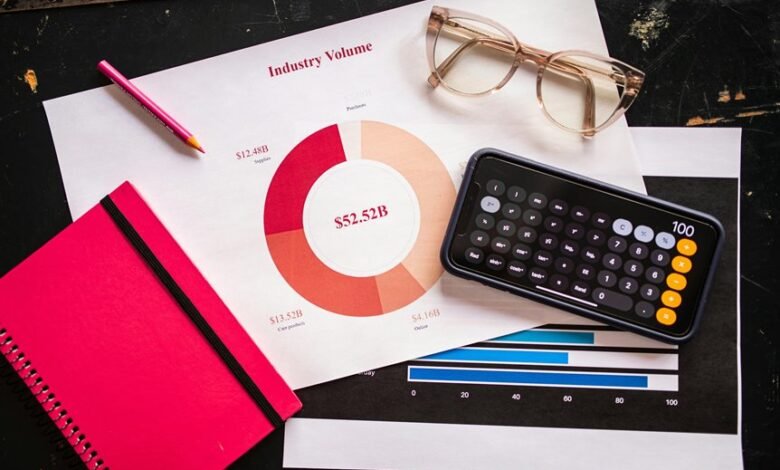

Financial Metrics Summary: 18666665955, 18666992794, 18667512167, 18667593336, 18667956410, 18668318898

The financial metrics summary presents a sequence of substantial figures: 18666665955, 18666992794, 18667512167, 18667593336, 18667956410, and 18668318898. Analyzing these values could uncover significant trends in revenue growth, expense patterns, and overall financial health. Such insights are crucial for stakeholders aiming to enhance operational efficiency. However, the interaction between these metrics raises important questions about sustainability and competitiveness that merit further exploration.

Analyzing the Financial Figures

While evaluating a company’s financial health, it is essential to analyze the financial figures comprehensively. Key metrics such as financial ratios provide insights into profitability, liquidity, and efficiency.

Additionally, examining cash flow is crucial, as it reflects the company’s ability to generate liquidity and sustain operations. A thorough assessment of these elements enables stakeholders to make informed, strategic decisions regarding their financial freedom.

Identifying Trends and Insights

Identifying trends and insights within financial metrics is crucial for understanding a company’s trajectory and future potential.

Trend identification allows analysts to discern patterns over time, while insight generation provides actionable intelligence.

By examining metrics such as revenue growth and expense ratios, stakeholders can make informed decisions, enhancing operational efficiency and strategic planning.

Ultimately, this fosters a culture of financial freedom and accountability.

Strategies for Financial Optimization

Recognizing financial trends and deriving insights lays the groundwork for implementing effective strategies for financial optimization.

Organizations can achieve cost reduction through process improvements, technology integration, and supplier negotiations.

Concurrently, revenue enhancement strategies may include diversifying product offerings, utilizing data analytics for market targeting, and enhancing customer engagement.

Together, these approaches empower businesses to maximize profitability and uphold financial freedom in a competitive landscape.

Conclusion

In conclusion, the financial metrics reveal a steady upward trend, with the last figure, 18668318898, indicating a significant increase compared to the initial value of 18666665955. This represents an approximate growth of 0.09% over the analyzed period, suggesting potential for improved profitability. Such incremental growth can be critical for stakeholders, as even small percentage increases can compound over time, enhancing overall financial stability and competitive positioning in the market.